When making a sale for resale, a common mistake that businesses make is accepting a copy of the purchaser’s seller’s permit, instead of a timely, valid, resale certificate. Businesses are frequently unaware of the difference between a seller’s permit and a resale certificate, and if they are, they often fail to put adequate controls in place to make sure a proper resale certificate is accepted. Understanding the difference is actually very important, especially for manufacturers, wholesalers and other business that commonly make sales for resale. Although sales for resale are one of the most fundamental exempt sales a business can make, it consistently makes up one of the largest areas of noncompliance uncovered in audits.

In California, a seller’s permit is required to be obtained from the Board of Equalization (Board) by “…every person desiring to engage in or conduct business as a seller within this state…” (Rev. & Tax. Code, § 6066, subd. (a)). A seller’s permit issued by the Board contains the permit number issued to the business, as well as the name and address of the business that is registered with the state.

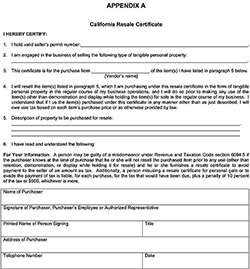

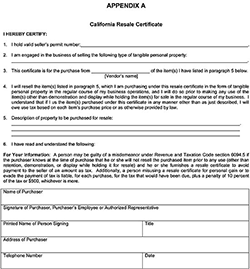

On the other hand, California Code of Regulations, title 18, section 1668, subdivisions (a), (b) & (c), define and summarize the requirements for obtaining resale certificates when a sale is for resale. These subdivisions provide, in summary, that a resale certificate can include any document describing the property purchased, such as a letter or purchase order. The Regulation further provides that the certificate must be timely provided by the purchaser to the seller (during the billing/payment cycle or before delivery), that the seller must take the certificate in good faith, and that the certificate should include the following five essential elements:

(1) The signature of the purchaser, purchaser’s employee or authorized representative.

(2) The name and address of the purchaser.

(3) The purchaser’s seller’s permit number. But if purchaser is not required to hold a permit because it makes no sales in this State, a sufficient explanation should be entered on the certificate, and we also recommend attempting to obtain the purchasers permit number for the state where it is headquartered.

(4) A statement that the property described in the document is purchased “for resale.” Phrases such as “non-taxable,” “exempt,” usually will not be accepted. The property purchased for resale must be described either by an itemized list, or by a general description.

(5) Date of execution of the document. However, an otherwise valid resale certificate will not be considered invalid solely on the ground that it is undated.

A seller’s permit provides a business with authority to make sales inside California. In contrast a resale certificate is a form that is provided from a buyer to a seller to support the exempt nature of a sale for resale that would otherwise be taxable. It is important for business owners to retain resale certificates they receive from their customers because in the event of an audit, a valid resale certificate “…relieves the seller from liability for sales tax…”(Rev. & Tax. Code, § 6092.) Further, a California resale certificate remains valid until it is revoked in writing by the purchaser. Unlike some states, it is not necessary, and generally not advisable, to update valid California resale certificates.

A seller’s permit alone does not contain all 5 essential elements as outlined in Regulation 1668. During an audit, the Board can, and often times will, disallow a claimed sale for resale and assess the tax on the seller who unknowingly accepts a seller’s permit instead of a valid resale certificate. Establishing that a sale was for resale, absent a valid resale certificate, after the fact during an audit can be a difficult and time consuming process. The Board provides a standard form on its website which, when properly completed by the customer, satisfies all of the elements as outlined in Regulation 1668. A copy of the form can be found at http://www.boe.ca.gov/pdf/boe230.pdf. If a valid, timely resale certificate is accepted in good faith, the seller will avoid any tax obligation, even if the purchaser ultimately consumes the property; in other words, even if the items purchased are not actually resold.

Being aware of the distinction between a seller’s permit and a resale certificate can save your business a lot of time and money in the event of an audit. It’s important to make certain that employees understand the distinction between a resale certificate and a seller’s permit, and that a resale certificate be accepted from the purchaser when items are being purchased for resale. One way to help employees understand the distinction is to point out that a document that appears to be issued by the Board of Equalization, i.e., a seller’s permit, is not a resale certificate. A resale certificate will be issued and signed by the purchaser, and it technically shouldn’t include the State’s insignia. The key to remaining in compliance starts with understanding the distinction, but that understanding must be reinforced with good controls that are consistently enforced by key personnel.

Finally, if you are audited, and the Board of Equalization, or other state agency, questions the validity of your resale certificates, be aware that other remedies exist to support the claimed exemption. Don’t accept an auditor’s claim that there is no other remedy to support the claimed exemption. In some circumstances, even if a business fails to obtain a proper resale certificate, and the purchaser uses the property, the purchaser can be held responsible for the tax. (Rev. & Tax. Code § 6244, subd. (a).)